MTU defies customs risks with record figures

Strong start to the year for MTU Aero Engines: In the first quarter, the engine manufacturer posted strong growth in sales and profits and exceeded expectations. But dark clouds are gathering on the horizon and casting a shadow over the current year.

After a surprisingly strong jump in profits and sales in the first quarter, German engine manufacturer MTU Aero Engines is bracing itself for possible economic turbulence caused by new US tariffs – and is nevertheless looking ahead with confidence. At the presentation of the final quarterly figures in Munich on Tuesday, CEO Lars Wagner warned: “The potential impact of the currently highly volatile US tariff policy on the global aviation industry is currently difficult to predict”. At the same time, however, he underlined the Group’s optimism and confirmed the ambitious profit target for 2025 – albeit with a caveat.

Solid growth at MTU – despite headwinds from overseas

Although MTU believes it is still “clearly on track”, the forecast does not include the possible direct and indirect consequences of new trade barriers for the time being. If no targeted countermeasures are taken, the customs burdens could cost the company mid to high double-digit millions, according to Wagner. In order to take countermeasures, the company is working closely with partners and is focusing on specific measures to mitigate the financial impact.

Just last week, MTU surprised with its preliminary figures for the first quarter – in a positive sense. The Group had to slightly adjust its sales forecast for the current year due to the weakening US dollar – it now stands at 8.3 to 8.5 billion euros. However, MTU is sticking to its target for operating profit (adjusted EBIT) and adjusted net profit: both key figures are expected to increase by around 15 percent compared to 2024.

Profit grows by 77 percent at MTU

The first quarter clearly exceeded expectations: the adjusted operating profit increased by a whopping 38 percent to 300 million euros – the bottom line was a profit of 224 million euros, which corresponds to a jump of 77 percent. In comparison: in the same period of the previous year, the figure was 126 million euros.

The growth is largely due to a significant increase in revenue. Turnover grew by 28% to around 2.11 billion euros in the first quarter, compared to 1.65 billion euros in the previous year. Adjusted, revenue rose by a quarter to just under 2.1 billion euros. Earnings before interest and taxes (EBIT) literally exploded by 67% to 314 million euros, while the adjusted figure rose by 38% to 300 million euros.

MTU’s goal: flying with hydrogen

While MTU struggles with short and medium-term trade barriers and volatile exchange rates, the Group has a clear vision for the future – and that vision is electric. Wagner anticipates the commercial launch of electrically powered passenger aircraft as early as the mid-2030s. In an interview with the Münchner Merkur newspaper, the CEO explained that fuel cell propulsion could soon become a reality, particularly for smaller aircraft with 20 to 30 seats.

The technology behind this is based on the Flying Fuel Cell (FFC) and is intended for use in regional air traffic on shorter routes. The FFC uses a fuel cell in which hydrogen and oxygen react to form water, releasing electrical energy. The energy generated drives a propeller via a gearbox, which is moved by an electric motor. This electric motor is the result of a collaboration between MTU and eMoSys GmbH, a company based in Starnberg that specializes in electric motors and has been part of MTU since 2023.

Long-haul remains a challenge – synthetic fuel as a bridging technology

For medium and long-haul jets, on the other hand, electrification remains a major challenge – the aircraft are simply too large and heavy for today’s batteries. This is where MTU is turning to alternative fuels: turbines that run on hydrogen or synthetic fuels. The biggest obstacle at the moment is the lack of infrastructure for the mass production of such fuels. But Wagner remains confident: “It’s worth it. After all, many of the 30,000 or so wide-body jets currently in use around the world will be flying for decades to come – so every technology that reduces CO₂ emissions counts.”

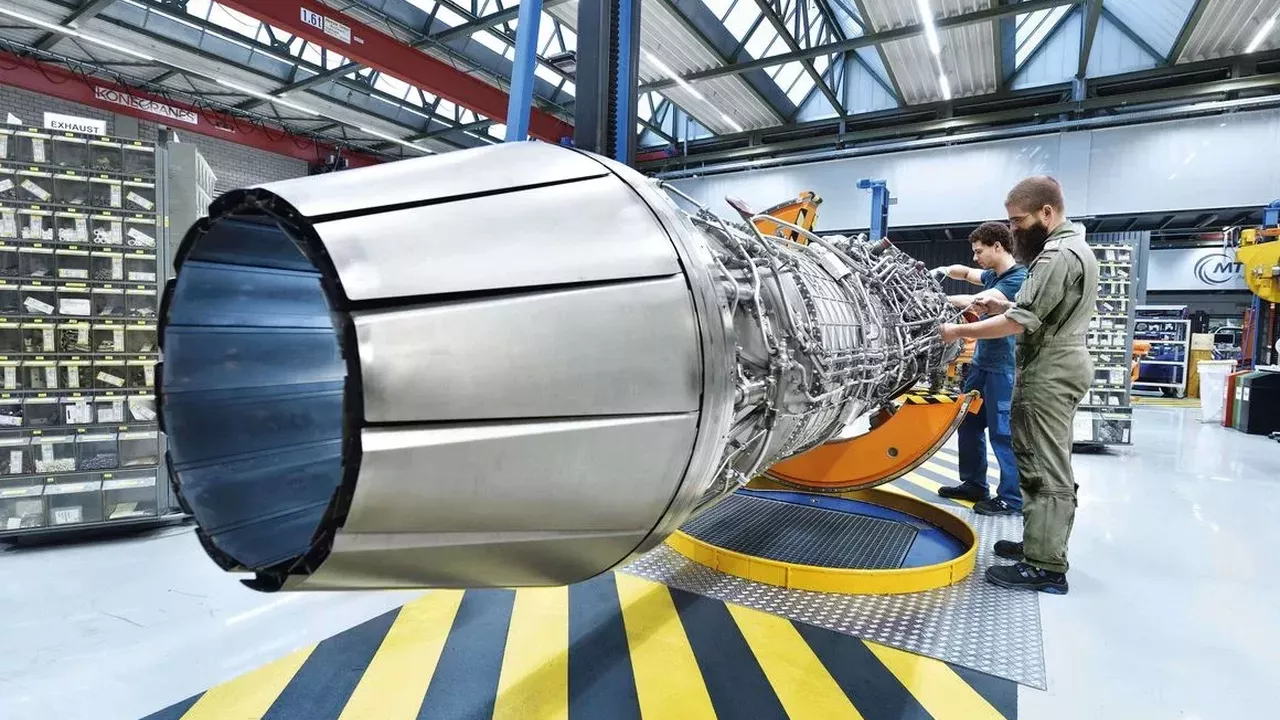

In addition to commercial aviation, MTU is also active in the military sector and is involved in the construction of the Eurofighter fighter jet, among other things – another mainstay in a group that focuses on diversification, innovative strength and long-term prospects, especially in uncertain times.